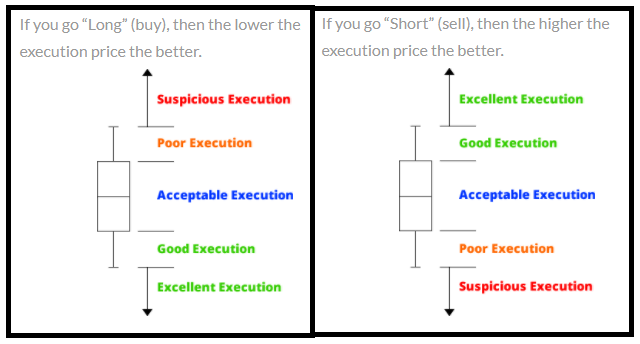

In terms of new regulatory requirements, brokers must be able to show that they have provided their customers with acceptable price execution. With no further guidance, both brokers and regulators have been looking for a solution. Because there is no central exchange for Forex and CFD transactions, it is difficult to assess the quality or otherwise of a broker’s execution. It is the single biggest issue in the relationship between brokers and their trader customers. VerifyMyTrade can show the price a customer received from their broker compared to a large sample size of brokers in the market. Depending on the direction of the trade VerifymyTrade classifies the acceptability of the execution.

The monthly regulatory report generated for a broker, analyses all the instruments for which VerifyMyTrade has statistically relevant comparable data and provides

- a summary view of the broker’s execution

- a summary by trader classification

- a summary of execution by instrument

- The service considers the varying spreads applicable to different account types and other nuances.