Transparency of

forex market execution

Our intent is to offer a service that encourages fair play in the forex market by allowing market participants to assess the quality of the execution their broker is providing.

Traders Do you want to check the competitiveness of your brokers pricing? Register, and you’ll get $10 to try our service

Regulatory Requirements

Checking the fairness of price of OTC products

Article 64 of the MiFID II Delegated Regulation requires firms to “check the fairness of the price proposed to the client when executing orders or taking decisions to deal in OTC products, including bespoke products, by gathering market data used in the estimation of the price of such products and, where possible, by comparing with similar or comparable products”.

ESMA expects that firms will need to make use of data analytics so that they can scrutinise the methodologies and inputs underpinning any valuation process and pricing models with respect to OTC products.

Solution

VerifyMyTrade collates market reference data against which brokers’ trades can be benchmarked. A report on a statistically meaningful sample of trades across a month could be compared to this reference data in order to provide a report to present to regulators as proof of the fairness of execution prices. While VerifyMyTrades cannot perform this in real time, we are able to provide a one day delayed audit of their Forex trade pricing.

Giving Users access to execution data

Currently firms must comply with the overarching standard of taking “reasonable steps…to obtain the best possible results for its clients”.

The new obligation under MiFID II is for firms to take “all sufficient steps” – a higher standard to comply with. However, ESMA have said that this overarching requirement should not be interpreted to mean that a firm must obtain the best possible results for its clients on every single occasion. Rather, firms will need to verify on an on-going basis that their execution arrangements work well throughout the different stages of the order execution process.

Solution

VerifyMyTrade allows users to check the execution results for all their trades. Naturally, some trades will be outliers, but it will show that the majority of trades are well executed, complying with MiFID requirements and ESMA guidelines.

Dispute resolution

While VerifyMyTrade is not intended to fulfill the role of a dispute resolution committee such as the Financial Commission or other industry regulatory bodies, we do provide a technological mechanism to assist in the dispute resolution process.

Solution

VerifyMyTrade can compile an authenticated email that can be sent among disputing parties and financial authorities in order to provide an independent view of the state of the market at a specific point in time. In many cases such information is sufficient for a party to admit fault, and in cases where there are other mitigating factors, the information can be used as a data point in the case.

What we do

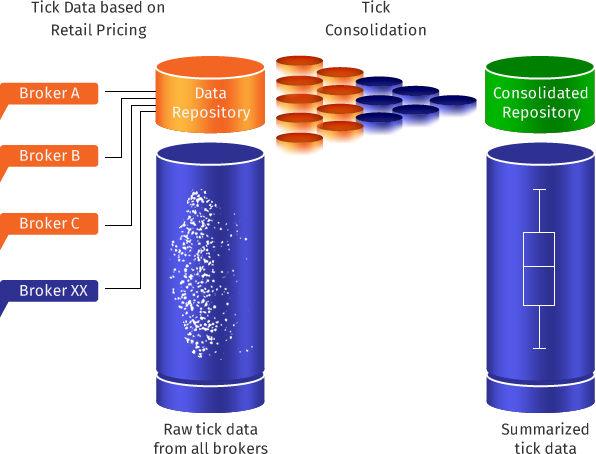

We consolidate price feeds from dozens of retail forex brokers and produce statistical box plots.

Box Plots are a representation of the minimum, maximum and percentiles of the ticks received for every second of the day. This is illustrated by the image below.

When one provides us with a trade’s details we can map the execution price received with the boxplot percentiles for that particular time of day.

Benefits

Benefits

For Traders

- Check that you are getting fair execution on your trades

- Avoid unnecessary costly and time consuming legal disputes with your broker

- Verify the competitiveness of your broker's pricing

- Register and we’ll give you $10 to use on Verify My Trade Services

For Brokers

- Check for irregularities in your execution before your customers complain

- Reduce back office costs when dealing with customer queries regarding pricing

- Show your customers that you hold yourself accountable for your service quality

- Compare your pricing with your competitors

For Regulators

- Quickly and simply review your member brokers' execution quality

- Allow you to focus your resources on brokers that consistently show poor execution

About us

We are an independent company, not affiliated to any broker. We are looking out for the best interests of retail traders. We do not, and will not recommend brokers with better execution. Our company’s objective is purely to create transparency, not to show favoritism to certain brokers.

If you are a broker, you can click here to read more about how our product deals with specific regulatory requirements for OTC Brokers.

Contact us

If you find your broker’s execution to be poor, please contact them directly. Feel free to mention our website so that they can compare their own execution quality against the industry.