Trade Execution and Price Analysis to help your brokerage be more profitable

We provide price and execution analytics to retail focused OTC brokers that enable them to be more competitive while addressing regulatory requirements.

Dealing desk profitability

Compare your pricing

To the retail OTC market or to a selected broker on both the bid and ask side over the short medium and long term.

Competitiveness

Quality of trade execution – of your broker compared to the broader OTC market price or to a selected broker.

Arbitrage risk

Assess risk traders can arb you based on your price differential to the retail OTC market or to a selected broker over time.

Identify Algorithmic / EA traders

Manage risk from these traders.

We are also building models to assess liquidity providers and are looking for brokers to work with to refine the offering

Marketing

Use the quality of your pricing and execution to attract and retain customers

New customer acquisition

Provide our certificate of assurance on the quality of your trade execution

Customer loyalty

Provide assurance to your existing customers that they are getting quality execution

Regulatory obligations

Provide assurance to your existing customers that they are getting quality execution

We understand OTC Markets, and our analysis methodology considers:

Retail OTC price data (NOT Interbank price data from Reuters or Bloomberg)

Spreads on different account types

Impact of news events on volatility

Let us be the independent third party that provides this insight to your prospects and customers

Dispute resolution

Independent Technology

We are not a dispute resolution committee like the Financial Commission or a regulatory body but we do provide the technology to optimise the process for these institutions to quickly assess cases

Retail OTC price data

We use directly comparable price data and NOT Interbank price data from Reuters or Bloomberg and take into account

- Spreads on different account types

- Impact of news events on volatility

Authenticated email

We provide a certified email to disputing parties and financial authorities in order to provide an independent view of the state of the market at a specific point in time. Resulting in clarity for all parties.

Regulatory Bodies

We provide regulators and institutional traders with an objective 3rd party assessment of the quality of trade execution for a broker by using an appropriate and direct comparable (being other retail OTC market makers) against which to benchmark execution.

Regulatory & Compliance Solutions

Trade Execution RTS 27

- Continual monitoring

- Market related benchmark

- Quarterly reporting

- Producing Reporting Tables

Top 5 execution venues (RTS 28)

- Continual monitoring

- Publishing of annual order routing practices

- Standardised formats

- Hosting of reports

- Detailed analytics

VerifyMyTrade collates market reference data against which brokers’ price execution can be benchmarked. A report on a statistically meaningful sample across a month could be compared to this reference data in order to provide a report to present to regulators as proof of the fairness of execution prices. VerifyMyTrade does not believe it is cost effective to perform the analysis in real time and provides a one day delayed result.

The new obligation under MiFID II is for firms to take “all sufficient steps” – a higher standard indeed. However, ESMA have said that this overarching requirement should not be interpreted to mean that a firm must obtain the best possible results for its clients on every single occasion. Rather, firms will need to verify on an on-going basis that their execution arrangements work well throughout the different stages of the order execution process.

VerifyMyTrade allows brokers to continually monitor execution quality. Naturally, execution quality will vary on the positive and negative side of the benchmark, but will ultimately show that the majority of positions taken are well executed, complying with MiFID requirements and ESMA guidelines.

What we do

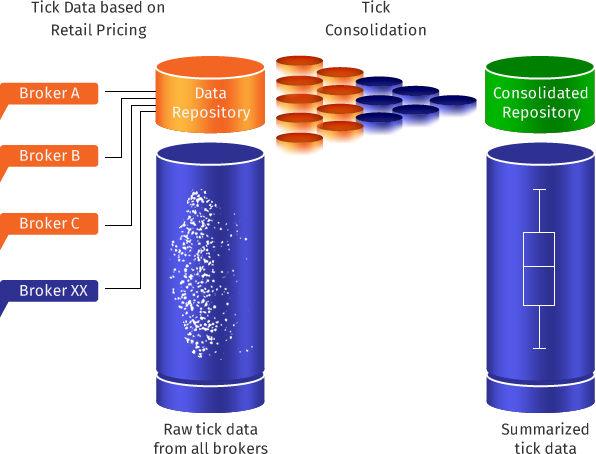

We consolidate price feeds from dozens of retail forex brokers and produce statistical box plots.

Box Plots are a representation of the minimum, maximum and percentiles of the ticks received for every second of the day. This is illustrated by the image below.

When we are provided with price execution details we can map the execution price received with the boxplot percentiles for that particular time of day.

Benefits

Benefits

Check for irregularities in your execution before your customers complain

Reduce back office costs when dealing with customer queries regarding pricing

Show your customers that you hold yourself accountable for your service quality

Compare your pricing with your competitors

About us

We are an independent company, not affiliated to any broker. We are looking out for the best interests of the OTC currency market and its participants. We do not, and will not recommend brokers with better execution. Our company’s objective is purely to create transparency, not to show favor.

If you are a broker, you can click here to read more about how our product deals with specific regulatory requirements for European OTC Brokers.

Our Partners

The Financial Commission (FinaCom PLC) is the first, neutral, third party Dispute Resolution Organization that is dedicated specifically to Forex, and it operates in a Way where transparency, Swiftness, and education are the paramount Values. The Financial Commission ensures that traders and brokers are getting their disputes resolved in a quick, efficient, unbiased and authentic manner, while making sure they walk away with a Well-founded answer, thus contributing to their overall knowledge about Forex.

![]()

Autochartist was established in 2004 and is currently servicing over 100 of the largest and most successful on-line brokers and institutions with financial market analysis content. Autochartist boasts a community of more than 1 million traders in over 80 countries worldwide. With data going back to 2010, Autochartist provides clients with a fully transparent service and aims to be in the forefront of a maturing market by being the independent analytical platform of choice. Committed to service excellence, tailoring solutions, and never slowing down with developing innovative new products that deliver high-quality, actionable potential trade opportunities, Autochartist is the market leader in automated financial market analysis.

Contact us

If you find your broker’s execution to be poor, please contact them directly. Feel free to mention our website so that they can compare their own execution quality against the industry.